Fibonacci is a huge subject in the world of trading. We have different Fibonacci ratios ranging from Fibonacci Retracement, Fibonacci Extension, Fibonacci Fan, Fibonacci Arcs, Fibonacci Time zones. But for the sake of simplicity, we would be dealing with just the retracement.

A lot of traders use the Fibonacci retracement levels as potential support and resistance areas. Since so many traders watch these levels in order to place buy and sell orders, this makes the support and resistance levels tend to become a self-fulfilling prophecy.

Most charting software comes with the Fibonacci retracement level tool. In order to apply Fibonacci levels to your charts, you'll need to identify Swing High and Swing Low points.

Fibonacci Retracement

The first thing you should know about the Fibonacci tool is that it works best when the market is trending.

The idea is to buy on a retracement at a Fibonacci support level when the market is trending up, and to sell on a retracement at a Fibonacci resistance level when the market is trending down.

In order to find these retracement levels, you have to find the recent significant Swing Highs and Swings Lows.

In order to plot it in a downtrend, you would have to click on the Swing High and drag the cursor to the most recent Swing Low and for an uptrend, you would do the opposite. Click on the Swing Low and drag the cursor to the most recent Swing High.

Let's take a look at some examples of how to apply Fibonacci retracements levels in the markets.

Uptrend Scenario.

Here we plotted the Fibonacci retracement Levels by clicking on the Swing Low and dragging the cursor to the Swing High. The software now shows you the retracement levels which are

As you can see from the chart, the retracement levels were 23.6%, 38.2%, 50.0%, 61.8% and 76.4%.

Now, the expectation is this pair retraces from the recent high, it will find support at one of those Fibonacci levels because traders will be placing buy orders at these levels as the price pulls back.

Let's take a look at what happened afterward in the image below.

Price eventually pulled back right through the 23.6% level and continued to move down until it tested the 38.2% level but was unable to close below it. The market resumed its upward move and broke through the swing high. Clearly, buying at the 38.2% Fibonacci level would have been a profitable trade!

Downtrend Scenario

Here we plotted the Fibonacci retracement levels by clicking on the Swing High and dragging the cursor to the Swing Low. The software now shows you the retracement levels.

The expectation for a downtrend is that if price retraces from this low, it will encounter resistance at one of the Fibonacci levels because traders will be ready with sell orders there.

Let's take a look at what happened next.

Price started moving up after the low and broke the 23.6% level into the 38.2% level, then made a slight break there and did as if it wants to come up but eventually went down breaking the 38.2% into 50.0% and broke that level also.

Finally, it was held at the 61.8% level and started an upward move from there which saw the price moving back to the lowest point and breaking past the 0.0% going further down. Clearly a very profitable trade there.

In these two examples, we see that price have a way of pausing at each level making it temporary support or resistance before breaking through that level or retracing back from that level. Because of all the people who use the Fibonacci tool, those levels become self-fulfilling support and resistance levels.

One thing you should take note of is that price won't always bounce from these levels. They should be looked at as areas of interest.

There is a clause you should always remember about using the Fibonacci tool. The clause is simple; fib level fails at times also just like every other support and resistance indicator. So let’s take a look at scenarios when it fails.

When Fibonacci Fails

Their golden rule of support and resistance with other forms of trading indicators is that they hold at times and they fail at times. This is why traders need to think in terms of probabilities.

Now, let's go through an example when the Fibonacci retracement tool fails.

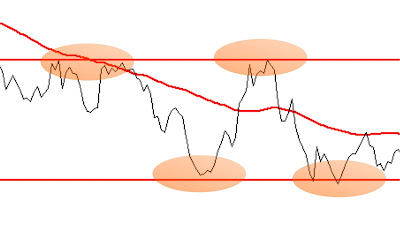

The image below is that of a pair that had seen a downward trend. The Fibonacci approach to this is to look for a possible retracement when this pair starts heading up so we can get in on a good level and follow it back down hoping that one of the fib levels will act as a resistance to the uptrend.

So we bring out our Fibonacci tool and draw in from the high of the swing to the low of it like you can see on the chart.

You can see on the chart that price first made a slight stop on the 23.6% then broke up to the 50.0% level. It dropped down a little bit from there then pushed up above the 61.8% level and we see it go up to the 100.0% and broke it upwards without even considering that level.

Assuming we placed a sell order at 23.6% or 50.0% level because of the way price behaved at those levels, we would have ended up with losing trades. It wasn’t a wrong decision; the price just didn’t respect those levels in this scenario.

The reason for this is because; traders look at charts differently, look at different time frames, and have their own fundamental biases. So a level that might appear as resistance on a smaller timeframe might actually be a support on a larger or a different timeframe.

That's why you need to hone your skills and combine the Fibonacci indicator with other indicators in your Forex toolbox to help give you a higher probability of success. You can’t rely on only one indicator.

Click here to go to the next lesson.

Click here to go to the previous lesson